Meaning it's beginning to inch higher and higher until it reaches the point that letter A was at.

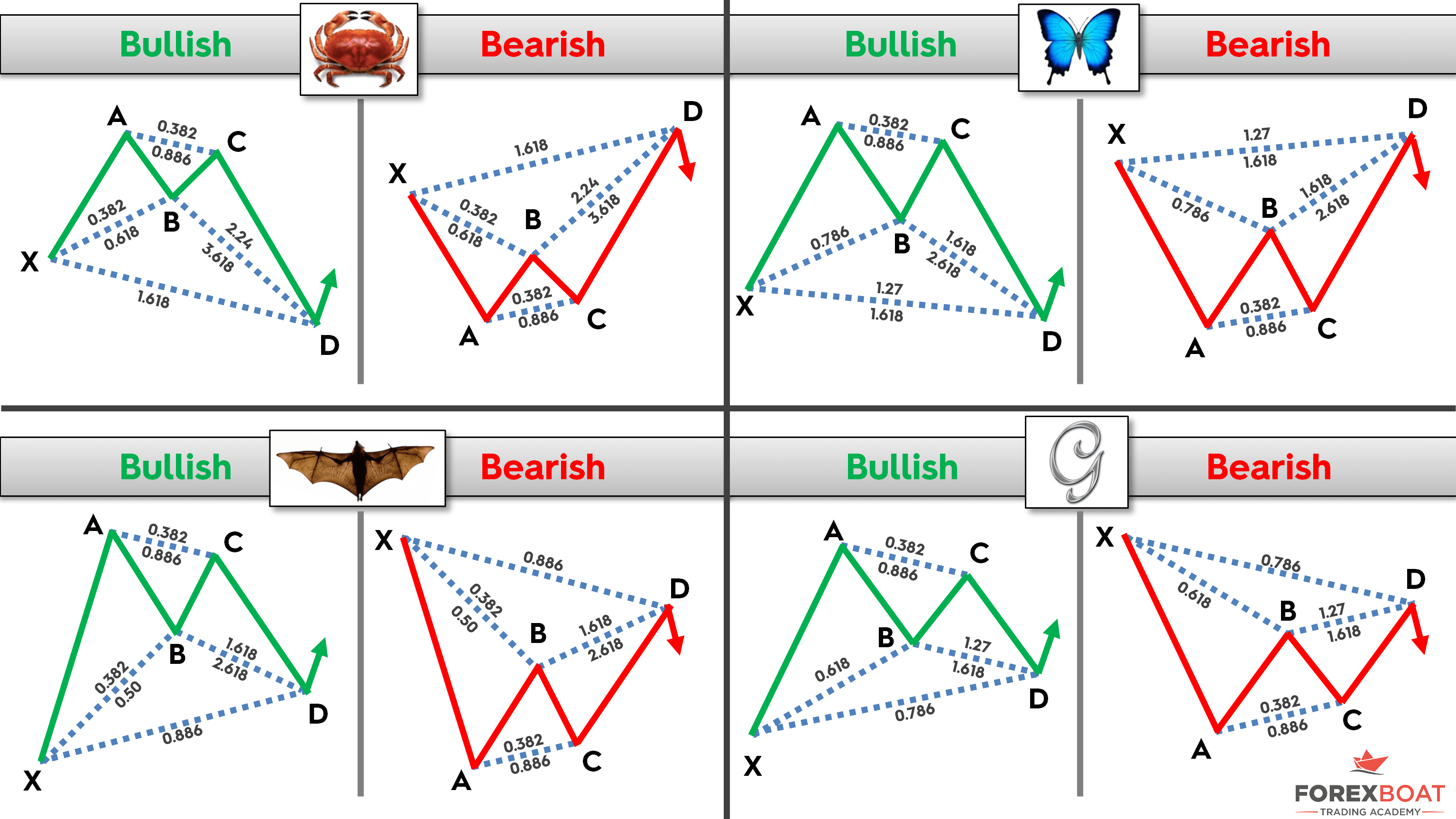

It seems like it's on a decline but, low and behold, it begins to rebound. The stock goes through a sharp price increase, then falls.Simply put, they consist of 3 consecutive price swings (A, B, C) and a buy or sell action (D). It is essentially a four-step sequential pattern that resembles a lightning bolt. Gartley in his 1935 book " Profits in the Stock Market", ABCD patterns, also written as AB=CD, is a frequently occurring pattern that's probably one of the easiest to spot. Officially published by Larry Pesavento and Scott Carney, but originally discovered by H.

ABCD PATTERN TRADING HOW TO

Here in this article, we'll go over the basics of ABCD patterns, how to identify them, how to capitalize on them, and what not to do - all to give you the information that other successful investors took years to learn: What's an ABCD Chart Pattern? Once you get the hang of it, being able to identify ABCD patterns can tell you when to buy and sell a stock, walking out with as many returns as possible while avoiding loss. Now, of all the very technical terms and mechanics that go into learning the different chart patterns and their meaning, ABCD chart patterns are probably the easiest to identify. There are repeating patterns in stock movements that, more often than not, can tell an investor whether a stock is about to increase or decrease in value. After a while, an experienced investor will learn how to identify chart patterns. Whereas other investors simply rely on pure luck to guide their investment decisions, more experienced investors rely on charts and graphs - reports of historic and projected prices of stocks.

0 kommentar(er)

0 kommentar(er)